Stonegate Group, the UK’s largest pub operator, is reportedly considering the sale of more than 40 pubs across Scotland as part of a wider strategy to “transform” its portfolio and reduce debt. This comes as the firm looks to sharpen its focus following significant challenges in the hospitality sector in recent years.

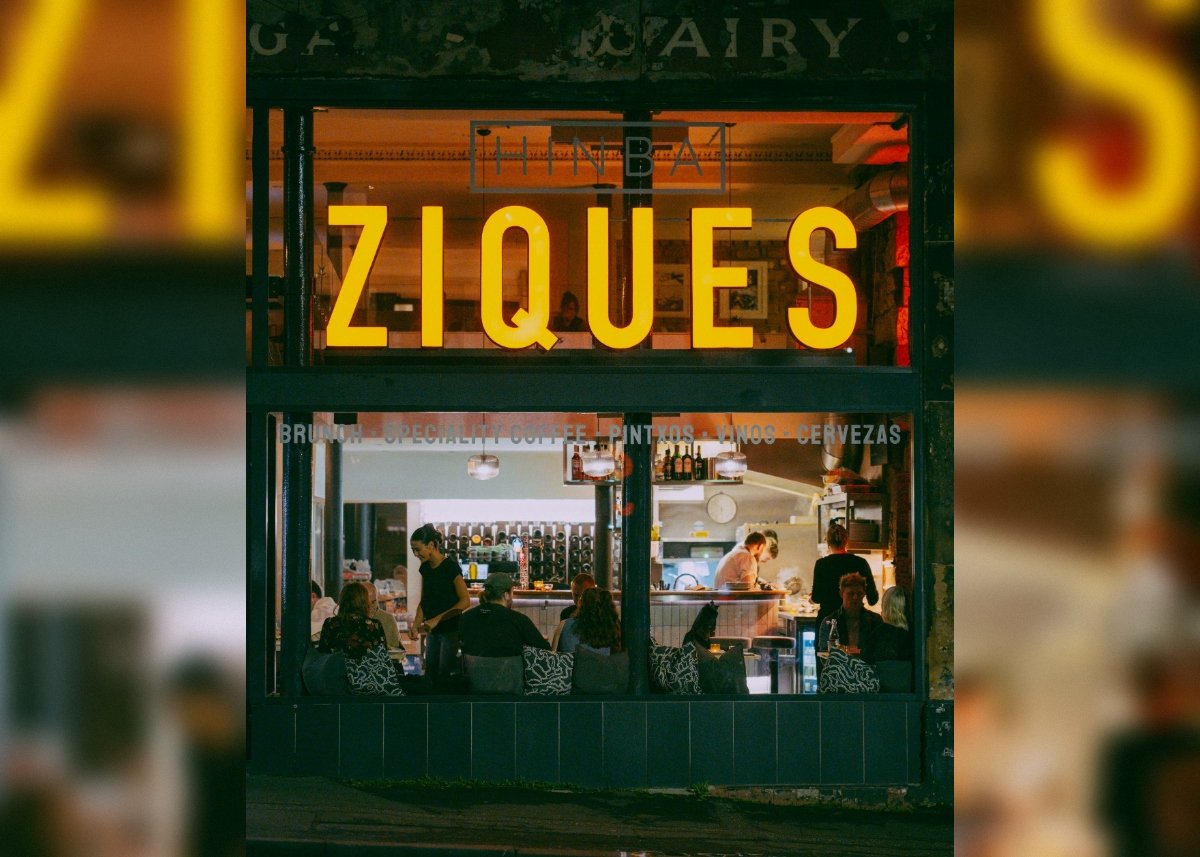

The pubs under review form part of what Stonegate refers to as its ‘platinum’ collection – its most valued properties, many of which are freehold premises. The company’s move to potentially offload this selection represents a radical reshaping of its estate, which currently includes over 50 pubs and bars throughout Scotland.

A spokesperson for Stonegate commented on the potential sales: “As the UK’s largest pub company, we regularly review our portfolio for divestment opportunities. This package being marketed by Savills is a business-as-usual transaction.” The firm seeks not only to streamline its estate but also to stabilise finances after posting sizeable losses in recent years, partly attributed to the lingering effects of the Covid-19 pandemic.

You Might Also Like:

David McDowell, Stonegate’s Chief Executive, has been steering the company’s transformation plan, aimed at returning the business to profitability. “The sale of assets, including some of our finest properties, forms a key part of our strategy to reduce debt and reposition Stonegate for sustainable growth,” he said.

Industry observers note that Stonegate’s potential sale could include iconic community pubs and high-profile venues, signalling notable changes for local hospitality scenes. However, the company reassures that all pubs involved will continue trading as usual until any transactions are completed.

This development follows a period where the UK pub market has been volatile, with other major chains similarly reassessing their portfolios. The move by Stonegate highlights the ongoing evolution in the pub industry as businesses adapt to changing market conditions and consumer behaviours.